Before you’ve booked the venue, bought the wedding dress, and picked out the flowers, there’s something you and your sweetheart need to do: sit down and figure out how much you can afford to spend.

Before you’ve booked the venue, bought the wedding dress, and picked out the flowers, there’s something you and your sweetheart need to do: sit down and figure out how much you can afford to spend.

Perhaps this is one of the most dreaded aspects of planning your wedding. Perhaps any form of financial planning is enough to make you want to hide beneath the covers and scream “make it go away.”

Or maybe you’re one of the lucky ones. Maybe you derive sweet satisfaction out of meeting money-related challenges head on. Maybe seeing those numbers in front of you gives you a feeling of clarity and control. After all, numbers don’t lie. They let you know exactly where you stand.

Whether you fit into one of the above categories, or fall somewhere in between, there’s no getting around the fact that your wedding budget will play a key role in your wedding plans.

Perhaps it’s the sole reason you opted for a small wedding. Maybe you took a good, hard look at your finances and reasoned that a large wedding would put you and yours up to your eyeballs in debt. Maybe you decided that you’d rather slim down your budget, and save the extra cash for a down payment on a house, or a new car. Or perhaps you and your partner came to the conclusion that you’d rather funnel money into your investments, than blow thousands on a one-day event.

How much can you afford?

Maybe you’re the type that oohs and aahs over pictures in bridal magazines. And even though you’ve opted for a small affair, perhaps you’d still love to have an elaborate wedding – with over-the-top floral arrangements on every table to a high profile 5-piece jazz band. Maybe you really want to go all out on your wedding.

The question is: Can you afford it, or will it put you and your honey in debt for years to come?

If you end up putting thousands of dollars on your credit cards, you could end up paying a lot more for your wedding than you ever imagined. Put it this way: Say you put $5,000 of your wedding related items on your credit card which has an annual interest rate of 18 percent. If you make minimum payments of $100 per month, it would take you over 7.5 years to pay off the debt and you’d have paid back not only the $5,000, but also over $4,300 in interest!

The best way to stay within a budget you can afford is to start planning early. That way you can begin saving for your wedding months ahead. Opening up a special wedding account can be a good idea. Putting 10 percent of your paycheck into the account can make for a sizeable chunk of cash after several months of saving.

Planning ahead will also give you time to comparison shop and find bargains. Clearance sales can save you a bundle!

When it comes to your wedding budget it’s also wise for both of you to get involved and to keep close tabs on your wedding expenses. Just because you’re having a small wedding, doesn’t mean those expenses can’t add up quickly!

Where your money will go

Even though your wedding will be small, you can still expect to spend most of your budget on your reception. Unless you are simply having appetizers or are having friends/family make the meal, food and beverages will make up a good portion of your wedding expenses.

Other significant expenses can be entertainment, attire, flowers, and photography.

The ceremony is generally one of the least expensive items.

Typical Wedding Budget Breakdown

50 percent – Reception

2 percent – Ceremony

8-10 percent – Attire

8-10 percent – Flowers

8-10-Entertainment/Music

10 percent – Photography/videography

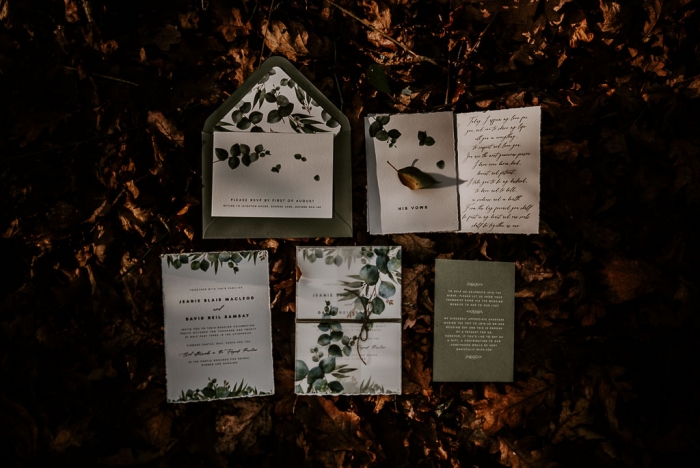

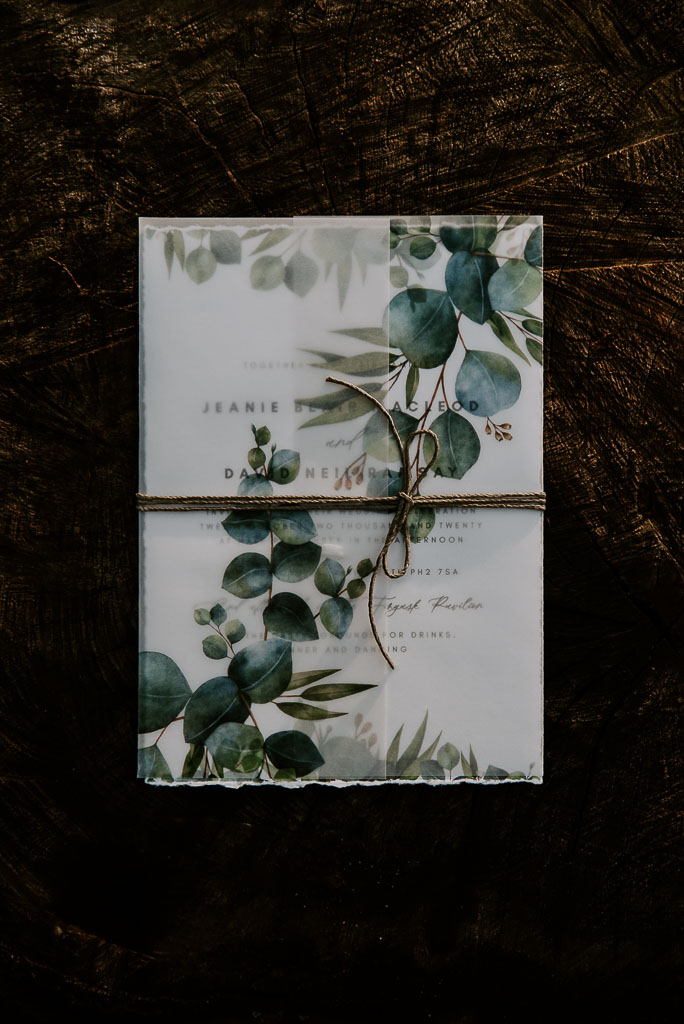

2 percent – Stationery

2 percent – Gifts

2 percent – Wedding rings

2 percent – Transportation and parking

6 percent – Miscellaneous expenses

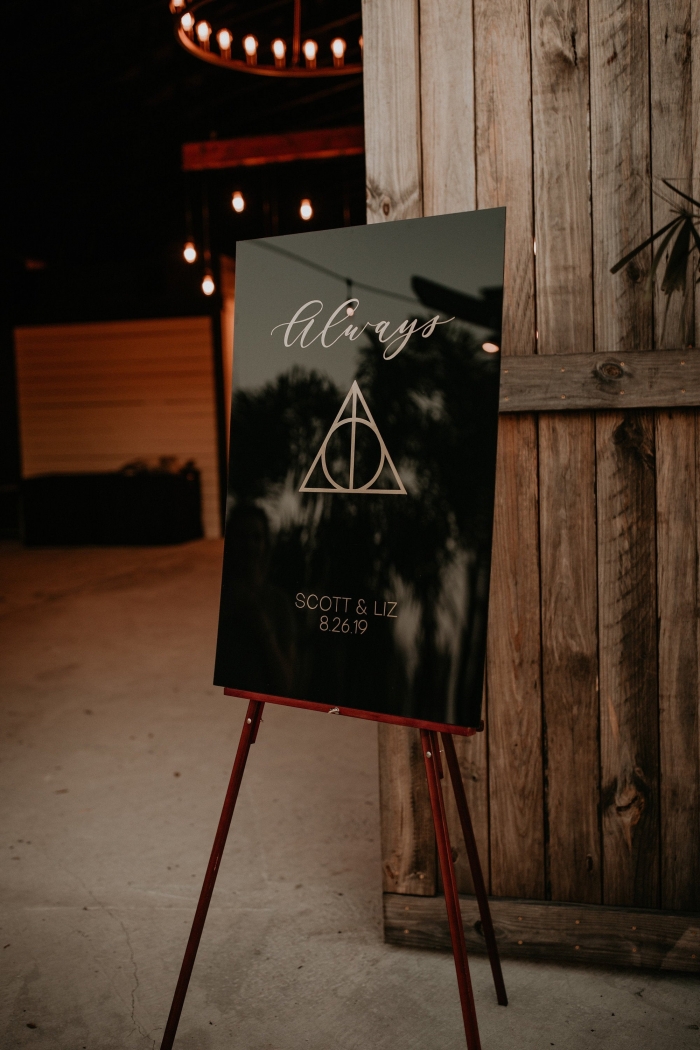

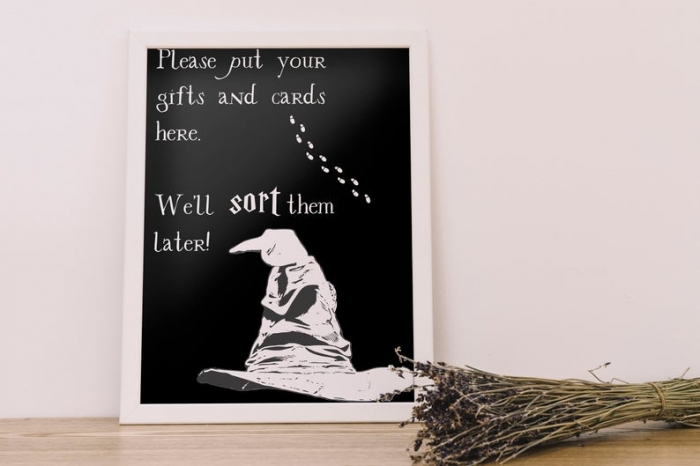

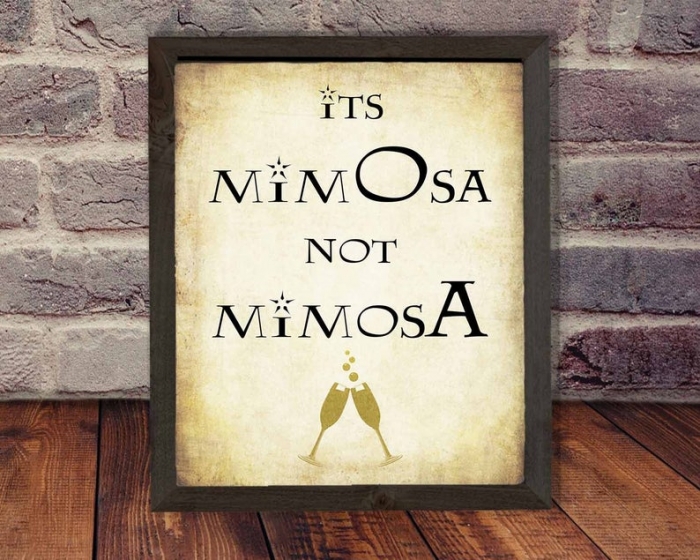

Photo One: Melissa Fe Chapman Photography; Photo Two: Adriana Klas Photography; Photo Three: Deyla Huss Photography